An accountant’s certificate is a document provided by a certified accountant that validates or confirms specific financial details of self-employed individuals in the United Kingdom. It is a commonly used document to support loan applications, mortgage applications, or immigration applications, among other documents.

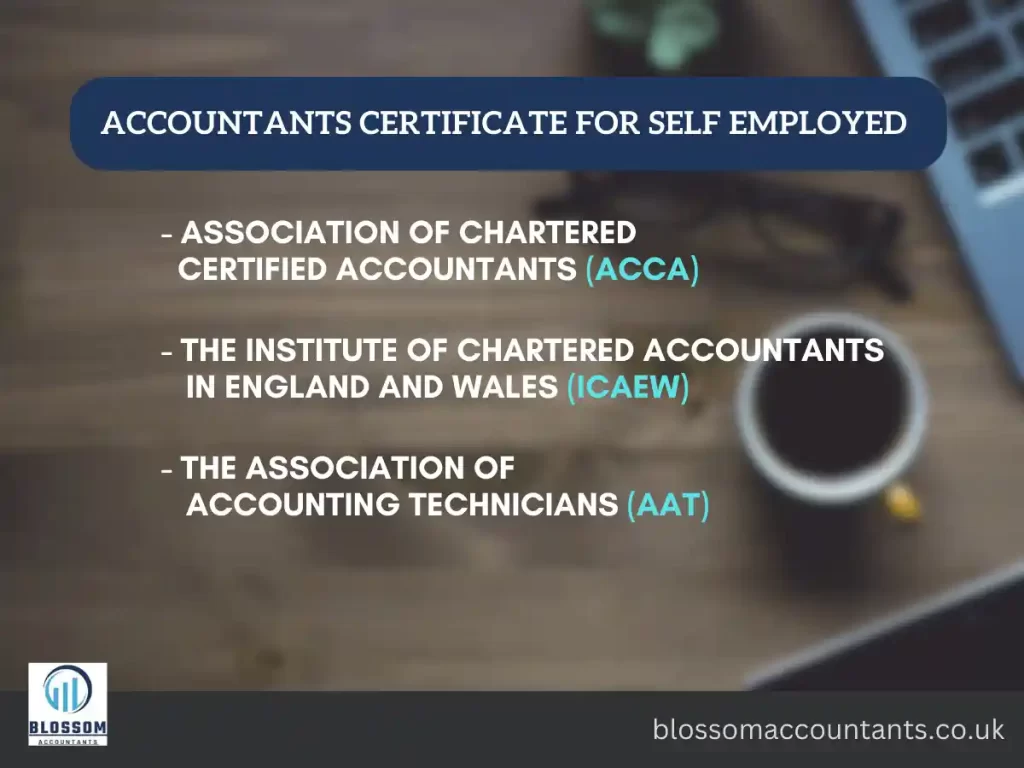

Only qualified accountants can issue accountants certificates in the UK. Below are the accountant bodies in UK who can issue you accountants certificate:

– Association of Chartered Certified Accountants (ACCA)

– The Institute of Chartered Accountants in England and Wales (ICAEW)

– The Association of Accounting Technicians (AAT)

Also read: SA1 Form – Self Assessment

If you need an accountant’s certificate for a specific purpose, it is advisable to contact a qualified accountant or accounting firm in the UK to discuss your requirements and obtain the necessary assistance. They will be able to guide you through the process and provide you with a certificate tailored to your needs.

Table of Contents

How to get accountants reference letter for self employed in UK?

To obtain an accountant certificate or qualified accountant reference letter in UK for a mortgage or to apply for any business loan in the UK, you need to follow below steps:

Hire a qualified accountant: It is important to hire an accountant who is experienced in creating the accountant certificate and knows what should be in the accountant’s certificate. The accountant should be qualified and authorized to issue an accountant certificate in UK

Provide necessary information and documents to the accountant: Share the required financial details (like bank statements, invoices, financial; statements and previous tax returns, and any other relevant financial details) with an accountant about you and your business. So an accountant can verify your financial situation which will help them to create an accountant certificate.

Schedule a meeting or consultation: Arrange a meeting or consultation with the accountant to discuss your requirements. During this meeting, you can provide the necessary information and discuss the purpose for which you need the accountant’s reference letter or certificate.

The accountant will review and verify your financial documents: The accountant will review the financial information and supporting documents you provided to verify their accuracy. The Accountant may ask for additional clarification or supporting documents if needed. The accountant will use their professional expertise to assess your financial situation and provide an accurate representation in the reference letter or accountant certificate which they will issue to you in the last.

Receive accountant reference letter or accountant certificate: Once the accountant has finished reviewing and verifying the financial papers, they will prepare the accountant’s reference letter or accountant certificate for a company loan or mortgage application. The accountant reference letter will contain the accountant’s contact information, qualifications, membership information, and a declaration validating the essential financial data.

Submitting the accountant reference letter or accountant certificate: Submit the accountant letter document for your business loan application or to the mortgage lender for the next steps.

Can I get mortgage without a sa302?

Yes, it is possible to get a mortgage without an SA302. The SA302 form is a document provided by HM Revenue and Customs (HMRC) that summarizes an individual’s income reported on their Self Assessment tax returns. While some lenders may request an SA302 as part of their documentation requirements, or some may demand for accountant letter also, not all lenders require it. Many lenders will accept alternative forms of income verification, such as tax calculations, tax overviews, or accountants’ certificates. It’s important to check with your mortgage lender or broker to understand their specific documentation requirements.

Also read: P6 Form – Tax Notice from HMRC

Which accountant can give accountants certificate in UK?

In the UK, accountants who are members of recognized professional bodies, such as the Association of Chartered Certified Accountants (ACCA), the Institute of Chartered Accountants in England and Wales (ICAEW), or the Association of Accounting Technicians (AAT), can provide accountants certificates. These professional bodies have their own guidelines and requirements that accountants must adhere to in order to issue such certificates. Therefore, it’s advisable to engage the services of a qualified accountant who is a member of one of these professional bodies when seeking an accountant’s certificate.

How much do accountants charge for accountants certificate for mortgage in UK?

Generally, accountants in the UK charge from £99 to £499 depending on the requirement and how complex your financial documents are. It is best to contact an accountant and explain the purpose why you require an accountant reference letter or accountant certificate. The accountant will understand your requirement and send the quote to you based on the documents and brief you shared with them.

How to download sample of accountants certificate for mortgage?

Sample templates of accountant’s certificates for mortgages can be found online (Tesco Bank or Skipton). While it’s important to note that each certificate should be tailored to your specific situation, these sample accountants certificate templates can give you an idea of the structure and content typically included in an accountant’s certificate for a mortgage.

DISCLAIMER: We have written the UK accounting and tax related details for your information only. For professional advice or for any accounting task you require, you may need to speak to a professional accountant near you who can assist you. Please read our disclaimer for more details.