A Corporation Tax reference number (also known as a Unique Taxpayer Reference or UTR) is a 17-digit number or 17 characters that is assigned to companies and other organizations in the UK that are registered for Corporation Tax. It is used by HM Revenue and Customs (HMRC) to identify and track the tax affairs of the company or organization.

You can find your company’s Corporation Tax reference number on your company’s incorporation documents, on your tax return, on a letter from HMRC, or on your company’s website. You can also contact HMRC to request your company’s Corporation Tax reference number.

To obtain a Corporation Tax reference number or UTR, a company typically needs to register for Corporation Tax with the HMRC.

If you are a company or organization that is registered for Corporation Tax, it is important to keep your Corporation Tax reference number safe and secure. You should not share your Corporation Tax reference number with anyone who does not need it.

Table of Contents

What is corporation tax reference number in UK or company tax reference number?

The Corporation Tax Reference Number (CTRN) and the Company Tax Reference Number (CTRN) are the same in the United Kingdom (UK). It is a unique identifier assigned to a company by Her Majesty’s Revenue and Customs (HMRC).

When a company registers for corporation tax in the UK, HMRC assigns a CTRN to that company. This reference number is used in all communications and interactions with HMRC regarding corporation tax obligations, including filing tax returns, making payments, and receiving correspondence.

Therefore, both the Corporation Tax Reference Number (CTRN) and the Company Tax Reference Number (CTRN) are synonymous terms used to refer to the unique identifier assigned to a company by HMRC to communicate with the company for tax-related matters or for any correspondence. For more details on filing your corporation tax with HMRC comment below and our team will connect with you.

How to apply for corporation tax reference number UK?

To apply for a Corporation Tax Reference Number (CTRN) in the UK, you need to follow these steps:

Register your company: Before applying for a CTRN, you must register your company with Companies House. This is typically done when incorporating a company or setting up a business entity.

Register for Corporation Tax: Once your company is registered with Companies House, you need to register for corporation tax with Her Majesty’s Revenue and Customs (HMRC). You can register online through the HMRC website or by mail using the form CT41G (for new companies) or form CT41G (Partnerships) for partnerships. Provide the necessary information about your company, including its legal name, registered address, date of incorporation, and other relevant details.

Receive your CTRN: After submitting the registration form, HMRC will process your application. Once approved, HMRC will issue your Corporation Tax Reference Number (CTRN) or Company Tax Reference Number (CTRN). This CTRN reference number will be sent to your company’s registered address.

Keep a record of your CTRN: Once you receive your CTRN, it is essential to keep a record of it as you will need it for all your future correspondence and interactions with HMRC regarding corporation tax.

If you want to apply for a corporation tax reference number or want to register a company in UK please comment below and our team will connect with you.

What is the difference between corporation tax reference number and UTR in UK?

In the context of the United Kingdom, the Corporation Tax Reference Number (CTRN) and Unique Taxpayer Reference (UTR) are related but distinct identifiers used for different purposes:

Unique Taxpayer Reference (UTR): The UTR is a 10-digit number assigned by Her Majesty’s Revenue and Customs (HMRC) to individuals and entities for tax-related purposes. It is a unique identifier that remains the same across different tax obligations, such as income tax, corporation tax, and Value Added Tax (VAT). The UTR is used to identify taxpayers and their tax records. It is typically assigned when an individual or entity registers for tax with HMRC.

Corporation Tax Reference Number (CTRN): The CTRN is a specific reference number used for identifying and managing corporation tax obligations. It is part of the UTR and specifically relates to the corporation tax registration. The CTRN is used for correspondence, filings, and payments related to corporation tax. It’s a 17 characters number assigned to corporation in UK by HMRC.

In summary, the UTR is a broader identifier that covers various tax obligations, while the CTRN is a subset of the UTR specifically dedicated to corporation tax. The UTR remains the same for an individual or entity across different taxes, while the CTRN is unique to the corporation tax registration.

Also read: CT61 Form

How can i find my corporation tax reference number?

To find your Corporation Tax Reference Number (CTRN) in the UK, you can follow these steps:

Check correspondence from HMRC: Look through any previous correspondence you have received from Her Majesty’s Revenue and Customs (HMRC) regarding your corporation tax. This includes letters, emails, or any other documents related to your tax affairs. Your CTRN may be mentioned on these communications.

Access your online tax account: If you have registered for an online tax account with HMRC, log in to your account. Once logged in, navigate to the section specifically related to corporation tax. Your CTRN should be displayed in the account information or profile section.

Contact HMRC helpline: If you cannot find your CTRN through the above methods, you can contact HMRC directly for assistance. The HMRC helpline for corporation tax can provide you with your CTRN. Ensure that you have your company’s details, such as your registered name and address, ready for verification purposes when contacting them.

Check your annual corporation tax return: If you have filed an annual corporation tax return in the previous years’ you can review a copy of the return or the computation provided to identify your CTRN.

If none of these methods help you locate your CTRN, it’s advisable to consult with a qualified accountant or tax advisor who can assist you in retrieving the necessary information from HMRC or guide you on the next steps to take.

Does corporation tax reference number changes every year?

No, the Corporation Tax Reference Number (CTRN) does not change every year. The CTRN is a unique identifier assigned to a company or organization by Her Majesty’s Revenue and Customs (HMRC) for its corporation tax obligations. Once assigned, the CTRN remains the same unless there is a specific reason for it to change. It is a permanent reference number that allows HMRC to track and identify the tax records and obligations of a company consistently over time.

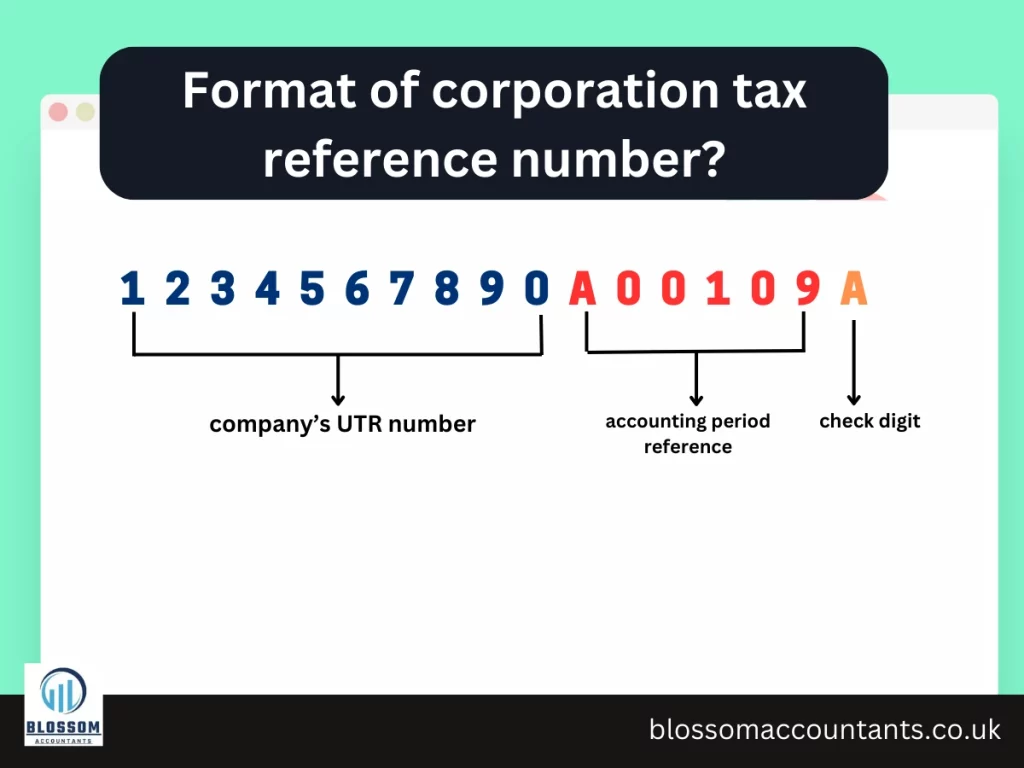

What is the format of corporation tax reference number?

The format of a UK Corporation Tax reference number is 17 characters long and is made up of the following:

The first 10 characters are the Unique Taxpayer Reference (UTR) number for the company or organization.

The next 7 characters are the accounting period reference assigned by HMRC

The last and final character is the check digit.

The UTR is a unique 10-digit number that is allocated to each company by HM Revenue and Customs (HMRC). The accounting period reference is a 7-digit number that is assigned to each company by HMRC. The check digit is a single character that is used to verify the accuracy of the reference number.

Here is an example of a UK Corporation Tax reference number:

1234567890A00109A

In this example, 1234567890 is the company’s UTR number, A00109 is the accounting period reference for the corporation, and A is the check digit which is same for every company.

Also read: CT600 Form

How to download application form to apply for corporation tax reference number?

To apply for a Corporation Tax Reference Number (CTRN) in the UK, you can download the application form from the official website of Her Majesty’s Revenue and Customs (HMRC) www.gov.uk/government/organisations/hm-revenue-customs.

In the search bar on the HMRC website, type “CT41G form“. The CT41G form is the application form used for registering for corporation tax.

Look for the search result that corresponds to the “CT41G form” or “Company details and corporation tax” form. Click on the appropriate link to access the form.

Download the form: Once you’re on the form’s page, you should find a link to download the form as a PDF or fill it online to apply CTRN. Click on the link to download the form to your computer or device.

Online registration to apply CTRN can be done through the HMRC website, and it eliminates the need to download and submit physical forms.

Additionally, it’s worth mentioning that the online registration process is now the preferred method for registering for corporation tax. The online registration can be done through the HMRC website, and it eliminates the need to download and submit physical forms.

DISCLAIMER: We have written the UK accounting and tax related details for your information only. For professional advice or for any accounting task you require, you may need to speak to a professional accountant near you who can assist you. Please read our disclaimer for more details.